India is at a Choke Point: Beware

☕ India’s Morning Briefing: Sat, December 06

Hello, and welcome to the brief.

Good morning, friends.

Rates are down, spirits are theoretically up, and the Russian Bear is currently hugging the Bengal Tiger in a geopolitical embrace that has Washington squinting. It is a “Goldilocks” moment for the macro-economy—not too hot, not too cold—but for the common man trying to catch a flight or sell a crop, the porridge is either missing or currently being blocked on a railway track in Punjab.

Welcome to the 175th edition of The India Brief

Do not miss the deep dive in the end

🇮🇳 The India Brief: Top Stories

ECONOMY & MARKETS: The Great Pivot

💸 RBI Cuts Repo Rate; A Surprise Pivot to Growth

The Move; In a unanimous decision, the Monetary Policy Committee (MPC) slashed the repo rate by 25 basis points to 5.25%, the first cut since February 2025.

The Rationale; Governor Sanjay Malhotra declared a “rare Goldilocks period” for India, citing 8.2% Q2 GDP growth and inflation projected at a benign 2% for FY26.

The Stimulus; The RBI announced a massive liquidity injection of ₹1.45 lakh crore via bond repurchases and a $5 billion dollar-rupee swap to manage currency volatility.

Outlook; FY26 GDP forecast revised upward to 7.3%, signaling confidence that domestic consumption will offset global headwinds.

Governor Malhotra essentially looked at the inflation dragon, patted it on the head, and decided it was tame enough to let the bulls run loose. After months of playing the strict headmaster holding the ruler of high interest rates, the RBI has transformed into the cool substitute teacher who lets the class watch a movie. The message to the market was clear: “Eat your porridge; it’s finally just right.”

💰 The Signal: This is a definitive strategic pivot. By cutting rates while the Rupee hits record lows (crossing 90/$), the RBI is decoupling from the US Fed’s hawkishness. They are betting that stimulating domestic capex and consumption is more critical than defending the currency’s optical value. The massive liquidity injection ensures banks—currently tight on cash—actually pass these lower rates to borrowers, directly aiding the real estate and auto sectors.

📈 Sensex & Nifty Rally on Rate Cut Euphoria

The Surge; The BSE Sensex jumped 447 points to close at 85,712, while the Nifty 50 settled at 26,186.

Top Gainers; Interest-rate sensitive stocks led: Shriram Finance (+3.04%), SBI (+2.49%), and Bajaj Finserv (+2.13%).

The Losers; FMCG giant Hindustan Unilever (HUL) fell 3.34% as it traded ex-ice cream business following the demerger of Kwality Wall’s.

Divergence; While large-caps partied, the Nifty Smallcap 100 dropped 0.57%, indicating caution in the broader market.

The stock market reacted like a toddler on a sugar rush. Banks are celebrating because cheaper money means more loans and bigger bonuses. Meanwhile, HUL is melting faster than a popsicle in a Delhi May afternoon, turns out, investors really liked the ice cream portfolio more than the soap.

🚢 Exports Rebound in November; Structural Flaws Remain

The Bounce; Commerce Minister Piyush Goyal confirmed November exports registered “healthy growth,” reversing October’s 12% contraction.

The Context; This follows a record trade deficit of $41.68 billion in October, driven by a massive spike in gold imports ($14.72 billion).

Key Stat; Total imports for April-October 2025 rose 6.4% to $451 billion.

🦄 The Capital Shift: Zepto & SoftBank’s Wins

The Shift; Zepto has converted its corporate structure to a public entity, a legal precursor to its massive IPO planned for 2026.

The Exit; SoftBank-backed Z47 fully exited Ola Electric, clocking 7-10X returns, a rare massive win for the Japanese giant in India.

The New Unicorn; Raise Financial became India’s latest unicorn, valued at $1.2 billion, signaling fintech remains hot.

The PSU Star; BPCL was named in the “Global Top 100 Corporate Startup Stars,” the only Indian PSU on the list.

Zepto is delivering an IPO prospectus faster than they deliver groceries—10 minutes or it’s free? Meanwhile, SoftBank finally making money in India proves that if you throw enough darts at a board (or billions at founders), eventually one hits a bullseye.

💼 The Signal: The quick-commerce war is moving to the stock market. With Swiggy and Zomato public, Zepto needs public capital to sustain the cash burn. Conversely, BPCL’s recognition shows state-owned giants are successfully pivoting to act as sovereign venture capital funds (”Project Ankur”) to secure their future in a post-oil world.

DIPLOMACY & DEFENSE: The Bear Hug

🛢️ Putin & Modi Seal “Uninterrupted” Energy Pacts

The Pledge; Russian President Vladimir Putin, in Delhi, promised “uninterrupted shipments”of oil and gas to India, defying US pressure.

The Trade; Both leaders targeted $100 billion in trade by 2030, with 96% of settlements already occurring in national currencies (Rupee-Ruble).

The Quote; Modi called the friendship “steadfast like a pole star,” while Putin praised India’s “independent” foreign policy.

The Optics; “Limo Diplomacy”—Modi and Putin shared a ride in Putin’s bomb-proof Aurus limousine.

The West wants India to dump Russia, but Putin just showed up with cheap oil and a “Buy One, Get One Free” coupon for nuclear reactors. It’s hard to say “Nyet” when the other option is paying full price in dollars. Nothing says “strategic partnership” like carpooling in a tank disguised as a luxury sedan.

🛡️ The Signal: This is a masterclass in strategic autonomy. India is locking in long-term energy security (hedging against OPEC) while ignoring US sanctions threats. The 96% Rupee-Ruble settlement rate is the real headline—it’s a direct challenge to the dollar-dominated global financial order, building a sanctions-proof trade corridor with an alleged war criminal.

⚔️ Su-57 & S-500: The Hardware Pivot

The Offer; Russia formally offered technology transfers to allow India to locally produce the Su-57 Felon stealth fighter.

The Upgrade; Talks also included the S-500 Prometey missile system, capable of intercepting hypersonic missiles and satellites.

The Context; India is exploring acquiring five more S-400 squadrons despite CAATSA risks, driven by China’s modernization.

LAW & DISSENT: The Twin Bills of Discontent

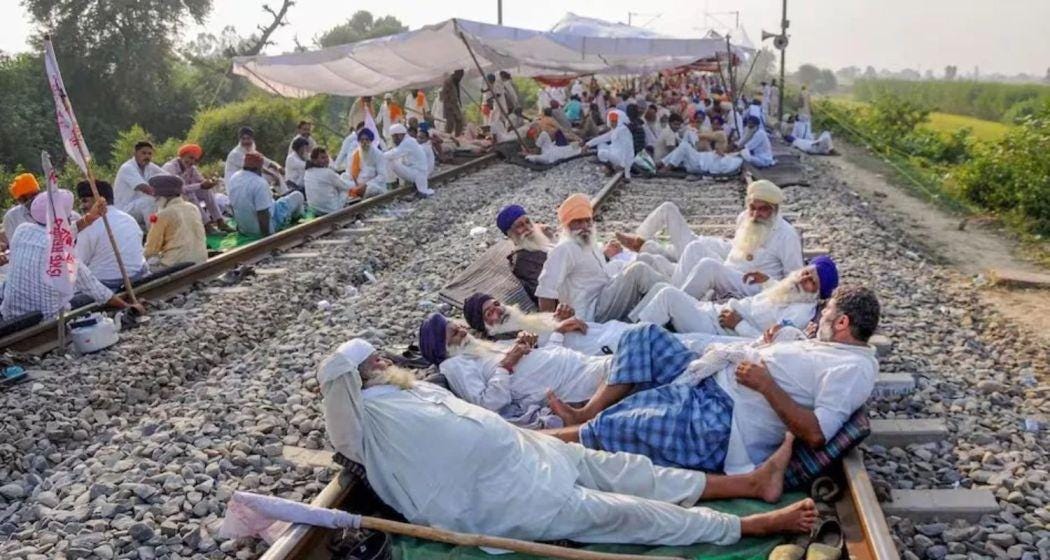

⚡ Punjab Farmers Launch “Rail Roko” Against Electricity Bill

The Protest; Farmers blocked railway tracks across 19 districts in Punjab, delaying 16 trains, to protest the Electricity Amendment Bill 2025.

The Fear; Farmers believe the Bill, which pushes for de-licensing distribution and cutting cross-subsidies, will end free power for tubewells.

The Scale; The Kisan Mazdoor Morcha (KMM) led the agitation, threatening intensified protests on Dec 8 if the government moves forward.

The Rationale; The Govt argues the bill is needed to save bankrupt Discoms and promote competition.

Attempting to install prepaid meters in rural Punjab is like trying to explain veganism to a lion. It’s not just about the electricity; it’s about the audacity of asking for payment upfront. The government calls it “reform”; the farmers call it “daylight robbery with a digital receipt.”

🚜 The Bottom Line: This is a clash between economic logic and political reality. The Centre wants to save Discoms (losses >₹1.6 lakh crore) by ending the culture of free power. The farmers view free power as a fundamental right. The “Rail Roko” is a warning shot; if the Bill passes, we are looking at Farmers Protest 3.0.

🌱 Seed Bill 2025: The “Corporate Capture” Controversy

The Bill; The draft Seeds Bill 2025 proposes mandatory registration of all seed varieties and a centralized accreditation system.

The Penalty; Selling unregistered seeds can lead to 3 years in jail and fines up to ₹30 lakh.

The Opposition; Critics argue the Bill favors MNCs by bypassing state powers and criminalizing traditional seed sharing that doesn’t meet “uniformity” standards.

The Defense; The government claims the SATHI portal will ensure seed traceability and stop fake seeds.

The government wants to QR-code every seed in the soil. Soon, a potato won’t be a potato unless it has a digital certificate and an Aadhaar card. Farmers sharing seeds over chai might soon be running an “illegal underground distribution network.”

🧬 The Deeper Take: This is about ownership of life forms. By mandating registration, the Bill potentially marginalizes indigenous varieties that are climate-resilient but not “uniform” enough for corporate catalogs. It shifts power from the cultivator (who saves seeds) to the corporation (who sells them).

⚖️ Supreme Court on Digital Content & Judiciary

The Tech; The Law Ministry detailed the use of AI for translating Supreme Court judgments and live-streaming proceedings.

The Ruling; The Rajasthan High Court ruled that adults can live together (live-in) even if they haven’t attained marriageable age (21 for men), reinforcing individual liberty.

The courts are using AI to translate judgments while ruling that 18-year-olds can live together even if they can’t get married. It’s a modern judiciary meeting a traditional society, and the result is a fascinating legal cocktail where “algorithm” meets “alimony.”

INFRASTRUCTURE & TECH: Skies & Tracks

✈️ IndiGo’s Systemic Meltdown: 500+ Flights Grounded

The Crisis; IndiGo cancelled 500+ flights over 48 hours, stranding thousands. Fares on key routes hit ₹50,000.

The Cause; A failure to plan for new Flight Duty Time Limitation (FDTL) norms led to a massive pilot shortage.

The Fallout; The DGCA intervened; IndiGo admitted normalcy might only return by February 2026.

The Relief; Indian Railways deployed 116 extra coaches across 37 trains to handle the overflow.

IndiGo used to be “on time.” Now it’s “on a prayer.” Charging ₹50k for a middle seat to Delhi is not dynamic pricing; it’s hostage negotiation. Their new slogan should be: “IndiGo: We might fly, we might not, but hey, the sandwich is still cold.”

🛑 The Signal: This exposes the fragility of India’s aviation duopoly. The new fatigue rules are vital for safety, but IndiGo chose profit over preparation, running lean rosters until the system snapped. Now, passengers pay the price for the airline’s efficiency obsession.

🤖 Google Gemini 3 “Deep Think” Launches in India

The Tech; Google rolled out Gemini 3 Deep Think, a new AI mode that uses “advanced parallel reasoning” to solve complex problems.

The Feature; It explores multiple hypotheses simultaneously, reportedly beating ChatGPT in reasoning benchmarks.

The Adoption; India is a key market, with 15% of daily searches now being “completely new” queries handled by AI.

Google’s AI can now “Deep Think,” which is more than I can say for most people on Twitter. It explores “multiple hypotheses simultaneously,” which is also what I do when deciding what to order for dinner.

CORPORATE & TECH: The Movers

🛢️ BPCL’s Startup Success

The Award; BPCL was named in the “Global Top 100 Corporate Startup Stars,” the only Indian PSU on the list.

The Program; Its “Ankur” initiative funds clean energy startups, pivoting the giant from “Big Oil” to “Big Tech/Energy”.

A PSU winning a startup award is like your grandfather winning a breakdancing competition—unexpected, slightly confusing, but undeniably impressive. It seems the anyone can indeed dance.

🌍 World Watch: Top Global

📺 Netflix Buys Warner Bros. Discovery for $72 Billion

The Deal; Netflix agreed to acquire Warner Bros. Discovery for an enterprise value of $82.7 billion.

The Assets; Netflix gets HBO, Harry Potter, DC Comics, and Game of Thrones.

The Impact; This creates a definitive “Goliath” of streaming, effectively ending the “Streaming Wars” via consolidation.

The Fear; Regulatory scrutiny will be intense; it’s a content singularity.

Netflix started by mailing DVDs; now it owns Batman. It’s the ultimate “started from the bottom” story. If you thought finding something to watch was hard before, just wait until one algorithm controls 50% of Hollywood.

⚓ South China Sea: China’s “Armada” of 100 Ships

The Escalation; China deployed over 100 vessels across the South China Sea, the largest flotilla ever recorded.

The Target; Aggressive maneuvers reported against Philippine vessels; Taiwan is on high alert.

The Response; The Philippines is launching a “transparency initiative” to publicise Chinese aggression.

China is playing “Battleship” in real life, but they forgot the part where you take turns. Sending 100 ships isn’t a patrol; it’s a traffic jam. They are trying to turn the sea into a Chinese lake through sheer congestion.

🔍 The Deep Dive: The Masterclass

The Great Indian Choke Point: Infrastructure, Dissent, and the Price of Reform

The Context Yesterday was a study in contrasts. On Dalal Street, investors popped champagne as the Sensex soared on a rate cut. In Delhi, diplomats toasted to “uninterrupted” Russian oil. But in the paddy fields of Punjab and the departure gates of Delhi Airport, the mood was one of fury. Two seemingly disconnected events—the “Rail Roko” protests and the IndiGo airline meltdown—are symptoms of the same condition: The friction of rapid modernization colliding with legacy fragility.

The Twin Bills: Why Farmers Are on the Tracks (Again) Trains across 19 districts in Punjab halted yesterday. Farmers are mobilizing against the Electricity (Amendment) Bill 2025 and the Seeds Bill 2025.

The Power Struggle: The government wants to save bankrupt Discoms (losses >₹1.6 lakh crore) by “delicensing” distribution, allowing private players to compete. Farmers fear “cherry-picking”—private firms will take profitable urban areas, leaving state boards with loss-making rural sectors, eventually killing the free power subsidy they rely on.

The Seed Sovereignty: The Seeds Bill mandates registration of all varieties. While intended to stop fake seeds via the SATHI portal, farmers see it as a trap. Indigenous varieties that don’t meet corporate “uniformity” standards could become illegal to sell, shifting control from the field to the corporation.

The Sky-High Failure: The Indigo Meltdown Simultaneously, IndiGo cancelled 500+ flights due to a pilot shortage.

The Cause: New Flight Duty Time Limitation (FDTL) norms prevented pilot fatigue (safety). But IndiGo, operating on razor-thin efficiency, failed to build a buffer. When the rules kicked in, the roster collapsed.

The Structural Flaw: India’s aviation is a duopoly. When the dominant player sneezes, the country catches pneumonia. The “efficiency” that made flying cheap has also made it brittle.

The Synthesis: The Price of Transition Both crises reveal the pain of transitioning from an “informal/state-subsidized” economy to a “formal/market-driven” one. We want 24/7 power but fear market rates. We want ₹4,000 air tickets but rely on overworked crews. We want modern seeds but fear corporate capture. The “Goldilocks” economy of 8.2% growth is real, but it sits atop a fragile foundation. The challenge for 2026 isn’t just growth; it’s resilience.

The Synthesis: What This Means for You We are entering a period of High Growth, High Friction.

Your Wallet: The RBI rate cut means home loans and car loans will likely get cheaper. It’s a good time to borrow, but a bad time to be a fixed-deposit saver (real returns are falling).

Your Life: Expect physical chaos. Infrastructure (airports, power grids) is being overhauled while running at 110% capacity. Travel disruptions and power fluctuations will likely worsen before they get better in 2026.

The Verdict: The economy is speeding up, but the tracks are still being laid. Hold on tight; it’s going to be a bumpy ride.

🎵 Sign-Off

Question of the Day: If Netflix now owns both Batman (DC) and Harry Potter, who wins in a fight: Voldemort or The Joker? (My money is on the Joker; chaos always beats magic).

Stay smart, stay grounded (literally, if you’re flying IndiGo).

Aditya S. Editor-in-Chief, OneRead.News

Brilliant. Your analysys of India's Goldilocks period is truly insightful. It makes me wonder, though, how quick that macroeconomic cascade really is. Will the common man feel this positive shift in real time, or is there always a lag in such complex systems?